We’ve talked in the past about why legal technology services providers are primed for a newspaper-like contraction. Both newspapers and law firms deliver a text-based product, delivered by geographically-focused entities that largely rely on their reputation and institutional rules to protect their business models.

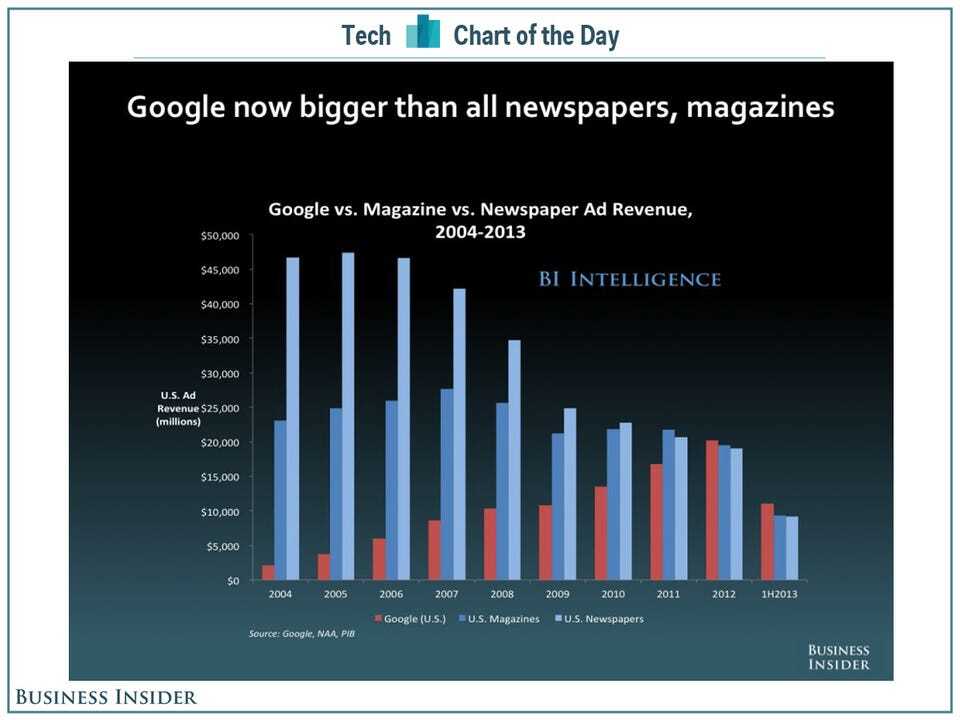

And both never believed that Internet-based technologies would impact their industries. Most lawyers still don’t believe it. But it’s not working out for most newspapers. The venerable Washington Post sold for a mere $250 million dollars to Jeff Bezos. Even more importantly, Google is now larger than both the newspaper industry and the magazine industry.

So how will disruptive technological shifts impact the legal industry?

Let’s look at the players:

1. Let’s assume magazines are really just “high-value” newspapers. Similar content vehicles, but with more well-considered and well-focused writing, more engaging design, and less transactional than newspapers. Magazines – while not growing exponentially – have at least held their ground. Really good content is hard to dis-intermediate. (Which explains Netflix and Amazon’s moves into generating their own content.)

2. Newspapers, which relied on easy-to-disrupt, low-value services (display advertising and classified advertising) suffered the most.

3. A disruptive technology for advertising not only gained market share, but is poised to expand it by providing a lower cost, higher-value service that brings additional buyers into the marketplace (small businesses who traditionally couldn’t afford display advertising).

So now let’s translate these to the legal profession:

1. High-value, prestige providers (which might only be a specific practice area within a larger firm) that maintain profit margins by providing a value that is irreplaceable. A great trial lawyer delivers value far beyond their billable rate. Just ask a successful plaintiff’s attorney. But this is not a growth market.

2. Legal service providers who cannot differentiate on the top end of practice value – but also cannot adapt to the disruptive technology. These are large, high revenue practice areas which cannot effectively differentiate from their competition.

3. Disruptive, technology driven players who not only take market share from 1 and 2, but grow the overall market through automated processes that make the service available to underserved markets.

And the same analysis can be applied to legal technology providers. Highly differentiated providers will survive (for now), but growth will be minimal as they fight over the biggest available projects. A largely undifferentiated middle tier will suffer at the hands of low-cost disruptors who leverage new technologies to deliver a new class of product. But the underserved legal markets – the ones which most technology vendors consider too small to consider – are where the future growth (and survival) of both the legal profession and the technology market will be.